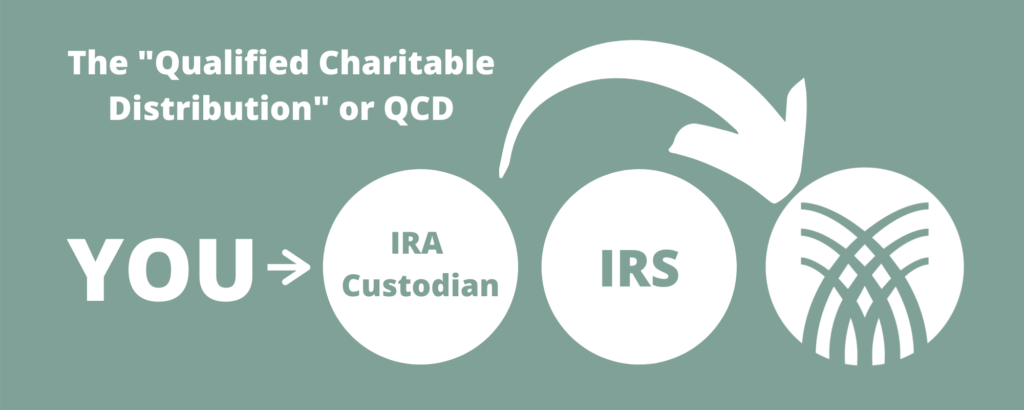

Creative Giving Strategies: The QCD

Many donors to the Nebraska Cultural Endowment (NCE) have found creative, fulfilling and strategic ways to make meaningful contributions to Nebraska’s arts and humanities.

One of these ways is through a Qualified Charitable Distribution (QCD) from an Individual Retirement Account (IRA).

Donating from your IRA maximizes your dollars to worthy causes such as the NCE.” – Donna Woods, NCE Board Member and Donor

If you are 70 ½ or older and want to make your charitable contributions go further, consider making a direct transfer from your IRA to a qualified charity, like the NCE. This strategy reduces your income tax burden by lowering or even eliminating your required minimum distribution. Additionally, the QCD avoids income-based limitations in charitable contributions, allowing you to give more and create deeper impact.

Using a tax-free transfer from your IRA to fund cultural organizations like the NCE enhances the quality of life for all Nebraskans” – Rhonda Seacrest, NCE Advisory Council Member and Donor

There are many other potential benefits of using this tool and a number of considerations to account for in deciding whether this is an effective charitable strategy for you. The NCE encourages you to discuss this option with your advisor, indicating that you would like to continue or increase your charitable support in the most tax-efficient way possible.

The Nebraska Cultural Endowment does not provide legal or tax advice. This information is general and educational in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.